Thinking of signing up for the SmartDollar program, then you must read this SmartDollar review.

Smart Dollar (Smart Dollar Club) is promoted as the solution to break free from living paycheck to paycheck and achieve financial freedom.

Study shows that 70% of American are living paycheck to paycheck.

People living paycheck to paycheck describe the state of their personal finances as “struggling” or in “crisis.”

Dave Ramsey offers Smart Dollar as a solution to help people take control of their money and break the paycheck-to-paycheck cycle.

The mission of Smart Dollar is to help people change their behavior toward money so they can use their income to save and invest instead of paying consumer debt.

However, the SmartDollar program isn’t going to work for everyone.

Many experts believe that it isn’t even the best way to achieve financial freedom.

Who is telling the truth?

In this review, we will uncover what is going on with the Smart Dollar program to determine whether it can help you achieve financial freedom.

Warning, Smart Dollar does not teach you how to build Wealth. Wealth Creation is the primary step to achieving financial freedom.

Tired Of Scams And Pyramid Schemes?

Your Work From Home Opportunity!

Smart Dollar Review Summary

| BUSINESS INFORMATION

|

NO FACE-2-FACE SALE – NO RECRUIT – JUST PASSIVE INCOME

CHECK OUT THIS #1 HOME-BASED BUSINESS

What Is Smart Dollar?

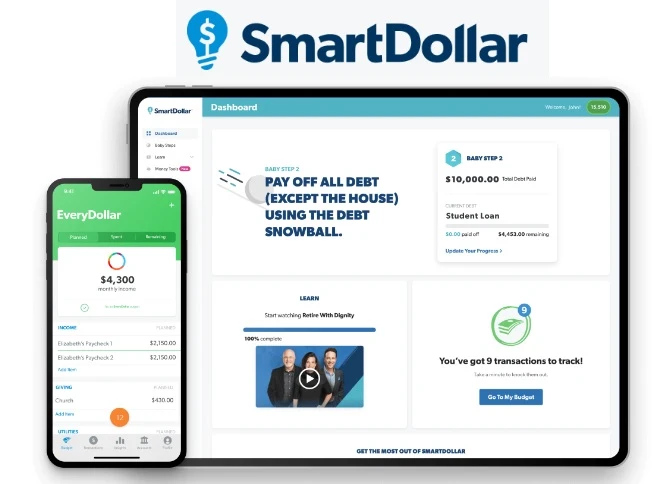

Smart Dollar is a fully digital product that teaches individuals to budget, pay off debt and save for retirement.

The program includes engaging content and financial tools to help members make real progress with their money, ending the cycle of living paycheck to paycheck.

Following Dave Ramsey’s 7 Baby Steps, you learn to stick to a budget, save for emergencies, eliminate debt, and save for the future.

You can focus on one step at a time and gain momentum to move through the plan and improve your finance for a lifetime.

Smart Dollar is a self-guided online program that is accessible 24/7.

You can access the program at any time, on any device, so you can participate on your own time when it’s most convenient for you.

It is the financial wellness solution that leads to lasting behavior change.

Smart Dollar promises to provide you with all the tools you need to take control of your money, reach your financial goals, and achieve financial freedom.

However, when you are living paycheck-to-paycheck, it can be challenging to set any money aside if you are on an extremely tight budget.

It is impossible to set aside $1,000 for an emergency fund and 15% of your income for retirement.

If you are in a financial jam, Wealth Creation is the primary step to achieving financial freedom.

Unlock the door to financial freedom with the

#1 home-based business opportunity!

Discover a way to earn over $100K a year from the comfort of your own home.

Don’t wait, click now to start your journey to success.

Who Is Dave Ramsey?

Smart Dollar is an employee financial wellness program created by Dave Ramsey.

He is the author of the bestseller Total Money Makeover and proponent of a money management plan called the 7 Baby Steps.

Countless people have used Dave Ramsey’s 7 Baby Steps to turn their finances around.

Ramsey is a world-class speaker empowering people about money and personal finance development through commonsense principles and education.

Dave Ramsey is one of the American most trusted sources for financial advice.

You can read this biography to learn more about Dave Ramsey.

Is Smart Dollar Legit?

Smart Dollar is a legit financial wellness program that adopts the 7 Baby Steps by Dave Ramsey to help you stick to a budget and get out of debt.

It provides a proven step-by-step plan where people learn to take control of their finance.

The program offers engaging content and digital tools to help you make actual progress with money.

Indeed, people have successfully used the 7 Baby Steps to turn their finances around, but it doesn’t work for everyone.

We will discuss situations that Smart Dollar does not work later in this review.

Just know this, a legit program is not necessarily the right program for you to achieve financial freedom.

How Does Smart Dollar Work?

Smart Dollar is a self-guided digital online program that you can access anytime on any device.

The program adopts the 7 Baby Steps created by Dave Ramsey.

You learn different financial lessons covering these topics:

- Budgeting

- Saving for Emergencies

- Paying Off Debt

- Saving for a Down Payment

- Investing in Retirement

- Saving for College

- Paying Off the House

- Building Wealth & Giving

Let’s cover the 7 Baby Steps of achieving financial freedom.

Baby Step 1

Ramsey’s first step is to save $1,000 for your starter emergency fund.

According to Dave Ramsey, a $1,000 emergency fund is sufficient to cover most emergencies.

You create an emergency fund by taking out a small amount from each paycheck and put directly into a very low-risk account, like a bank savings account or money market fund.

Baby Step 2

Ramsey’s second step is to pay off all debt (except your mortgage) using the debt snowball method.

This method calls for paying off the smallest debts first to get them out of the way.

You then pay off large debts in ascending order.

The snowball method works because it’s all about changing your behavior.

Once paid off the smallest debt, all the money rolls into the second debt, and more money means more snow.

Baby Step 3

Ramsey’s third step is to save three to six months of expenses in an emergency fund.

The goal here is to beef up your savings so that you can withstand unexpected events that may come your way, such as a job loss.

Baby Step 4

The fourth step in Ramsey’s strategy is to invest 15% of your household income for retirement.

Investing in retirement accounts is something you should do as soon as you start working.

Ramsey recommends using tax-deferred accounts like an IRA and a 401(k) if your employer offers them.

Baby Step 5

Saving for your children’s college fund is Ramsey’s step number 5.

You can skip this step if you don’t have any offspring.

However, never over-invest in your child’s future education to the detriment of your retirement savings.

Your kids may or may not go to college, but you will absolutely want to retire.

Baby Step 6

Step 6 is to pay off your home early.

One primary advantage of paying off your mortgage is the peace of mind and financial freedom it will bring.

Baby Step 7

The seventh and final step is to build wealth and give.

The idea is that once you reach this step, you should be debt-free. All of your money is yours.

SmartDollar also provides you with digital tools to complete the 7 Baby Steps.

EVERYDOLLAR BUDGET APP

The budget app helps you create a budget to track transactions during the month.

EMERGENCY SAVINGS PLANNER:

This tool helps users save their $1,000 starter emergency fund in under 30 days.

DEBT SNOWBALL TOOL

The Debt Snowball organizes debts automatically and motivates you to pay off debt faster than ever imagined.

RETIREMENT SAVINGS PLANNER

This tool helps you plan and get on track for the retirement of your dreams.

In addition, SmartDollar includes Ask Dave radio show clips, wellness assessments, quizzes and lessons, budget forms, and one-on-one coaching.

How Much Does Smart Dollar Cost?

Smart Dollar is free if offered by your employer.

The Ramsey financial coach program typically costs between $200 to $350 per session.

However, companies can purchase Smart Dollar for the cost of $67 per employee per session.

Smart Dollar is an employee financial wellness program.

Employers provide this program as part of their benefits package.

Usually, Smart Dollar is not available to individual consumers to purchase.

Smart Dollar Pros and Cons

Smart Dollar is a worthwhile financial planning scheme that might help you achieve a debt-free life more quickly.

But it isn’t foolproof.

Here’s our assessment of the 7 Baby Steps in Smart Dollar.

Smart Dollar Pros

- It provides a roadmap to start managing your money and setting financial goals.

- The 7-baby-steps is a good money blueprint for any individual to follow.

- Smart Dollar offers sound financial advice.

- It encourages people to save, pay off debts, and invest.

- It helps you to build a stable financial future.

Smart Dollar Cons

- Smart Dollar is very rigid and does not leave much room for individualization. Because tackling them one at a time may not work for everyone.

- The 7 Baby Steps work for some, not for others.

- These steps are overly simplistic. You can’t focus on one goal at a time. It is not how financial planning often works. Instead, one must juggle many goals and priorities.

- The Debt Snowball is not the most effective method of paying off debts. The problem is the higher interest debts continue to compound while you’re paying off the smaller debts. It ends up costing you more with the Debt Snowball.

Our biggest problem with Smart Dollar is the program offers no Wealth Building strategy.

Is Smart Dollar Worth It?

Smart Dollar doesn’t appear to be a program for people living paycheck-to-paycheck to achieve financial freedom.

The program focuses on paying debts, not creating wealth.

The number doesn’t add up when you have no money left from each paycheck to pay down debts or invest.

I am speaking from experience. I lived the paycheck-by-paycheck lifestyle.

You never have any money. The Smart Dollar program could not help in this situation.

How can you pay debts when you have no money to buy food?

If you are searching for ways to break free from living paycheck-to-paycheck, the first step is to create wealth, earning extra cash.

You can generate more income by getting a second job or taking on a side hustle to earn passive income.

Generating passive income is the method that I have used to achieve financial freedom.

I am not saying it fits you, but who knows?

If you want to achieve financial freedom, I suggest reading this article, the #1 Business Opportunity To Generate Passive Income Online. It will show you the most lucrative business to start today.

Every year, millions of people earn a six-figure passive income using this online business.

I use the same business system to fire the boss, work from home, and achieve financial freedom.

Let me explain to you why:

You can use This #1 Home Business Opportunity to create a full-time passive income. You can work from the comfort of your own home and on a laptop, with no commute and no boss. You work whenever you want and where you like.

I invite you to read What I Do Every Day To Make Money At Home Online. Let me show you the real system of generating passive income.

I hope this Smart Dollar review answers your questions about the program.

Until next time.

Please, share your experience below.